how to avoid estate tax in california

22 Make the property your primary residence. 21 Sell the property as fast as you can.

California Estate Tax Everything You Need To Know Smartasset

You filed a joint return for the year of sale or exchange.

. Estate planning strategies in California. California does not levy a gift tax. No California estate tax means you get to keep more of your inheritance.

These factors look to the State in which the following occurred. Proposition 19 passed in 2020 significantly limited the parent-child exclusion. Even if youre not in California there are still capital gains taxes depending on how your property was classified.

Below we review a number of different ways you can avoid the. Federal estate tax in California. This base rate is the highest of any state.

The law gives states the power to take. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. In turn there are a number of strategies you can use to minimize what you owe or avoid estate taxes altogether.

Birth marriage raising family. However the federal gift tax does still apply to residents of California. The exemption for 1000000 of other property is no longer effective.

Although there is no California inheritance tax there could be certain situations where an individual would rather reject an inheritance. The surest way to avoid or reduce estate taxes in California and other states is to give off portions of your estate as gifts to your beneficiary. Avoiding Probate in California Estate.

The following are your options to avoid probate here in California. Probate laws will vary from state to state. Under Oregons estate tax property passing to non-spouse persons in excess of 1 million is taxed at a graduated rate of 10 to 16.

The two years dont need to be consecutive but house-flippers should beware. 2 How to Avoid Inheritance Tax and Capital Gains Tax in California. Live in the house for at least two years.

How do I avoid capital gains tax on real estate in California. There are ways individuals can protect their assets by avoiding probate so that they can pass the maximum amount possible down to their heirs. California sales tax rates range from 735 to 1025.

23 Defer your taxes as an. It is also common for California residents to change residency to avoid being tax for the sale of a substantial business. For instance a company based in Arizona but with assets and operations.

Do this while you are still alive every year. If you want to reject or disclaim an. Your gain from the sale was less than 500000.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The California legislature has yet to pass the rules to interpret the exact implantation of Prop. 18 to 40 on estates over 117 million.

19 although it has already. How to Avoid Capital Gains Tax on Real Estate. Set Up A Living Trust to Avoid Probate In California.

The California Capital Gains Tax is due to both federal the IRS and state tax agencies the Franchise Tax Board or FTB so its common to feel like one is being double. With the exception of the estate tax for estates exceeding 1158 million dollars per person California does not have a state-level inheritance tax. The taxable estate would need to exceed.

Ad From Fisher Investments 40 years managing money and helping thousands of families. That is not true in every state. However the voter initiative did expand the ability of older adults to move and transfer their property tax basis to a.

California is quite fair when it comes to property taxes when you look. The California Personal Income Tax Law allows the state to take property from someone who owes 10000 in taxes or any amount above that. Ad From Fisher Investments 40 years managing money and helping thousands of families.

The following factors are helpful in planning to establish nonresident status in California. MarriedRDP couples can exclude up to 500000 if all of the following apply. Inheritance tax in California.

Income Tax Services Bellflower Tax Lawyer Tax Attorney Tax Services

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

2022 California Property Tax Rules To Know

வர ய ச ம க க ம ம ற வர ம னவர க ற ப ப Tax Planning Income Tax In 2021 Estate Tax Income Tax Income

Understanding California S Property Taxes

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Understanding California S Property Taxes

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

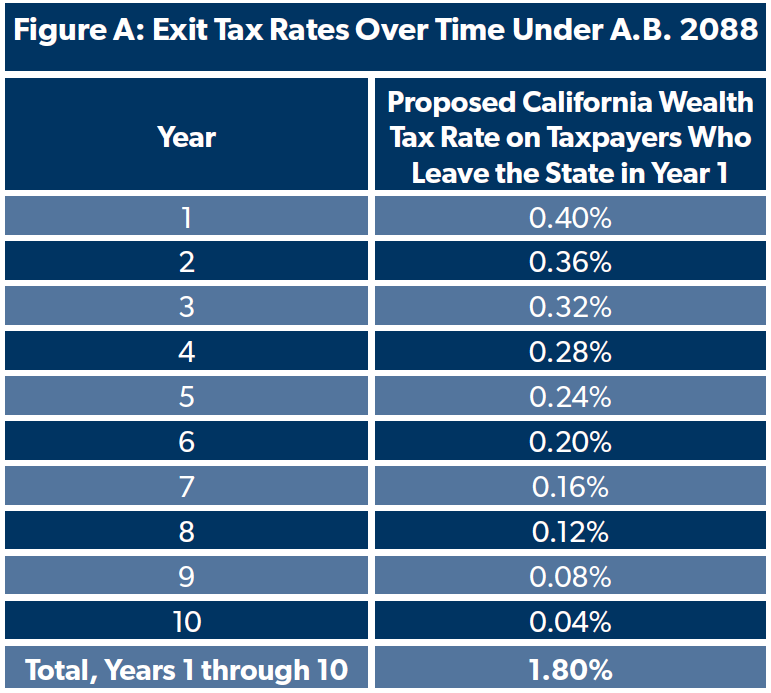

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Estate Tax Tables Estate Tax Tax Table Tax

The Taxlawyerlosangeles Will Make Sure That You Are Not Accused Of The Tax Lawyer Tax Attorney Business Lawyer

California Estate Tax Everything You Need To Know Smartasset

Taxes On Your Inheritance In California Albertson Davidson Llp

California Estate Tax Everything You Need To Know Smartasset

You Know That California Tax Attorney Is An Expert On Taxes They Know About All The Components Of Tax In Calif Tax Attorney Tax Lawyer Financial Management

Is Inheritance Taxable In California California Trust Estate Probate Litigation